LEON Founder Potential Case Study

Enhancing investment decisions, this study reveals the correlation between the LEON Founder Potential Model and superior investment returns.

In the intricate world of venture capital, investors are persistently seeking ways to refine and optimize their due diligence processes, leading to better-informed investment decisions.

This quest has steered the LEON team to conduct an extensive study that explores the relationship between firm-level due diligence and founder potential for generating superior returns. At the heart of this research is the proprietary LEON Founder Potential Model, an innovative tool that has been employed by a diverse range of firms, from emerging start-ups to top-tier funds and their founders in today's fast-paced and competitive landscape. The findings have revealed a compelling correlation between the model's scores and the Multiple of Invested Capital (MOIC), highlighting the model's capacity to predict high-performing investments.

Methodology:

Our methodology involved utilizing a sophisticated survey tool, purpose-built to capture a wide array of metrics related to both founders and their companies. Founders were asked to fill out a three-minute survey, with questions based on geometric, non-linear answer types, thus creating a narrative path to understand their potential.

Personal Metrics:

Creative: Founders were asked to rate their ability to generate unique, innovative ideas and devise effective solutions, providing a measure of their creative prowess.

Builder: This metric gauged the extent to which founders perceive their capability to transform ideas into realities, such as products, services, teams, and entire organizations.

Critical Thinking: Founders self-assessed their capacity to analyze complex situations, consider diverse perspectives, and make informed, strategic decisions.

Salesmanship: This measured how proficient founders believe they are at presenting and promoting ideas, products, or services convincingly to a variety of stakeholders.

Adaptability: Founders were asked to rate their resilience and flexibility in responding to changes, such as alterations in market conditions, customer needs, or business strategies.

Honesty: This metric was based on the extent to which founders see themselves as committed to integrity, transparency, and ethical behavior.

Company Metrics:

Capital Position: Founders evaluated the current financial standing of their startup, including the amount of secured funding and the financial sustainability of the business.

Market Fit: This measure involved founders assessing how well their startup's product or service aligns with current demand within the target market, as well as the potential it has to satisfy customer needs.

Investment Metrics:

Founder Dependency: This metric gauged the degree to which founders believe their startup's success and continuity depend on their presence and involvement.

Track Record: Founders self-rated their history of professional achievements, previous startup experience, and past successes, which may serve as indicators of potential future performance.

Commitment: This measure captured the level of dedication, time, and energy founders are willing to invest in the startup.

Pressure: Founders assessed their capacity to manage stress, maintain performance under challenging circumstances, and navigate adversity.

Value: This metric was based on the founder's assessment of their startup's potential to generate significant returns, create a meaningful impact in its market, and uphold the core values defined by its mission and vision.

These combined metrics from the survey were then processed by the LEON Founder Potential Model to assign a unique score to each founder. This score was subsequently compared with the MOIC to assess the model's predictive accuracy and the ability of the founder to deliver positive financial results.

Key Findings:

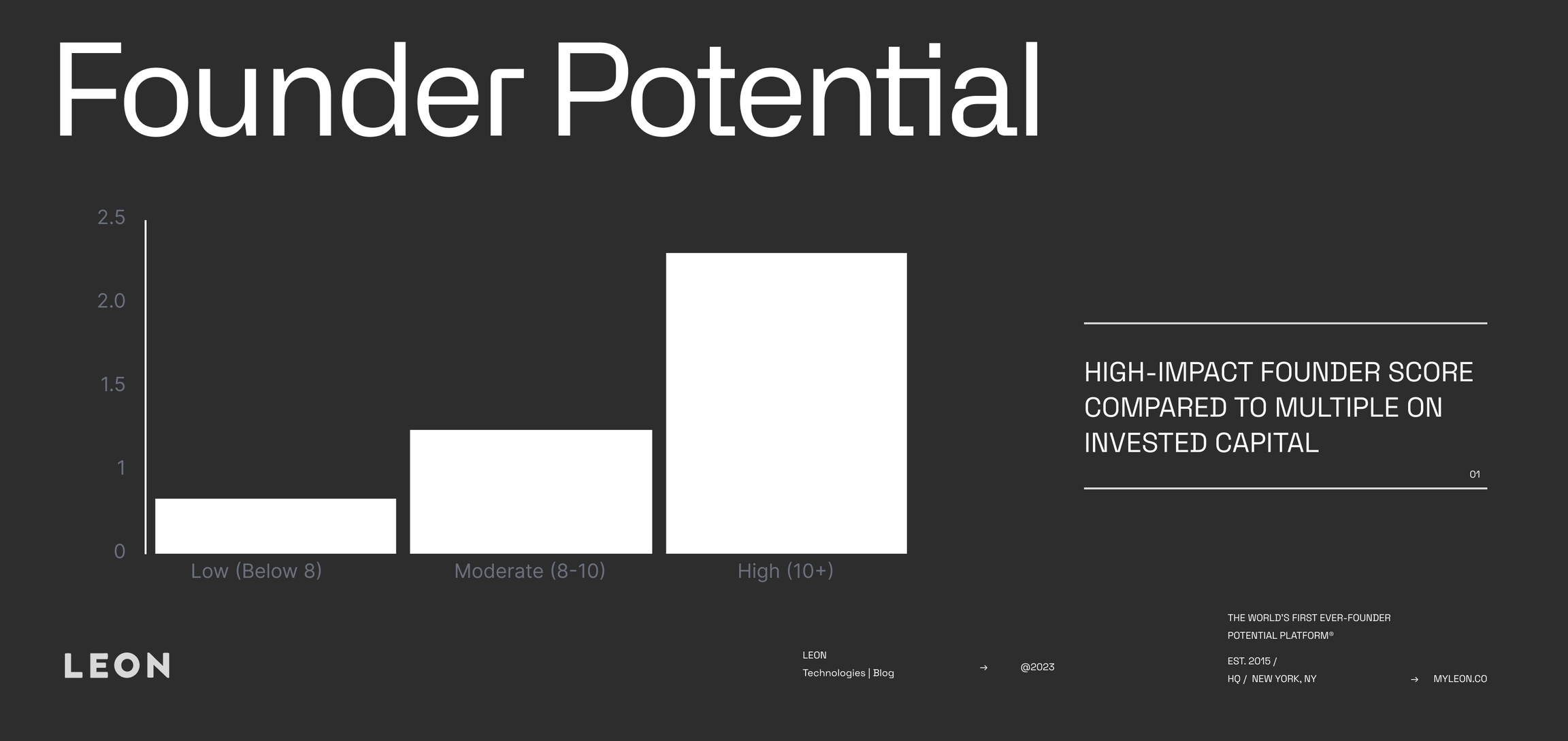

The outcomes of the study were thought-provoking and reinforced the model's effectiveness. It was found that higher LEON founder potential scores directly correlated with higher MOIC, indicating the model's accuracy in predicting investment success.

More specifically, founders who were ranked in the top quartile by the LEON Founder Potential Model were associated with better investment returns. This finding provides investors with a reliable way of identifying high-potential founders and investments.

Conversely, founders who scored in the mid to low quartile were associated with lower investment returns. This observation highlights the model's capacity to discern the founders that are likely to generate less impressive returns, thereby assisting investors to avoid potentially underperforming investments.

Comparison with Other Models:

When juxtaposed with existing models used for similar investment predictions, the LEON Founder Potential Model holds its own in terms of both predictive power and accuracy. Many conventional models often rely on financial metrics and tangible attributes, potentially neglecting the critical role played by the founders. The LEON model, on the other hand, centers on the founder's attributes, considering a range of characteristics, from creativity to honesty. The nuanced approach used by the LEON model has demonstrated a unique value proposition, evidenced by the strong correlation between the LEON Founder Potential Score and the MOIC in the study.

Limitations and Future Research:

While our study's findings are encouraging, we must acknowledge several inherent limitations and opportunities for improvement. The research was conducted on a sample size encompassing over 170 firms and 830 founders, which, although considerable, is predominantly limited to a specific business context. The findings, therefore, may not be universally applicable across different contexts or sectors. We recognize the value of broadening the research scope to include a more diverse range of business environments and an expanded sample size to further substantiate the conclusions drawn.

Our model relies heavily on self-assessment, inherently introducing a level of subjectivity and potential response bias. This subjectivity may impact the accuracy of the LEON Founder Potential Score. To mitigate this, future research could incorporate a 360-degree feedback approach, where assessments are also solicited from other significant stakeholders such as peers, subordinates, and investors. In addition, integrating more objective datasets, such as the founder's work history and educational background, could contribute to a more comprehensive and balanced understanding of the founder's potential.

Finally, we acknowledge that the current version of the LEON Founder Potential Model does not factor in the potential impact of external variables, such as economic conditions or industry trends, which could significantly influence a founder's success and the resultant MOIC. Future iterations of our model should consider integrating these external factors into the scoring algorithm to enhance its predictive accuracy and overall relevance in varying market scenarios. These improvements would undoubtedly refine our model, making it an even more valuable tool in the due diligence process.

Implications:

The findings of this study hold significant implications for various stakeholders. For venture capitalists, angel investors, and startup accelerators, the LEON Founder Potential Model offers an additional layer of information for making more informed and potentially lucrative investment decisions. It can serve as a guide to identify high-potential founders, ultimately improving the efficiency of their due diligence process.

For founders, understanding the metrics that contribute to a high LEON score can provide valuable insight into areas they might need to develop or emphasize when seeking investment.

Application:

Investors interested in applying the LEON Founder Potential Model in their due diligence process could follow these steps:

Survey: Have the founder(s) complete the 3-minute LEON survey as part of the initial screening process.

Score: Utilize the LEON model to compute a Founder Potential Score based on the survey responses.

Compare: Compare the Founder Potential Score with other key due diligence metrics, like a business plan, market size, and product uniqueness.

Consider: Use the score as one of many factors in the investment decision. A high score might favor investment, while a low score may indicate the need for further examination or caution.

Monitor Post-investment, revisit the LEON Founder Potential Score periodically, and monitor changes over time to help manage and support the portfolio companies better.

The integration of the LEON Founder Potential Model into the due diligence process could provide a more holistic understanding of the founder's potential and, in turn, the potential for high investment returns.

Conclusion:

This study conclusively demonstrates that the LEON Founder Potential Score is a potent tool for identifying high-potential founders and, in turn, high-return investments. As such, it can serve as an invaluable indicator for success, asset allocation, and increased returns on investment.

By integrating the LEON Founder Potential Model into their due diligence processes, investors can make more data-driven decisions, allowing for better risk management and potentially improved investment outcomes. This innovative approach to due diligence signals a shift towards a more predictive model of investing, promising an exciting future for venture capitalists and founders alike.

Last updated