Founder Potential Case Study

Enhancing investment decisions, this study reveals the correlation between the LEON Founder Potential Model and superior investment returns.

Abstract

The LEON Founder Potential Model provides a novel methodology for assessing founder potential within the venture capital sector. This paper delineates a detailed investigation, establishing the correlation between the model's assessment scores and the Multiple of Invested Capital (MOIC), employing data derived from 150 venture funds. Diagnostic evaluations post-funding were utilized to ascertain predictive accuracy. The study's findings, supported by statistical analyses underscore the model's efficacy in forecasting investment success.

Research Problem and Relevance

Quantifying the abstract qualities of founders that contribute to a startup's success remains a challenge. This research contributes to the field by offering empirical evidence on the effectiveness of the LEON Model, derived from existing research and tailored to fit within a robust predictive framework.

Purpose and Objectives

The purpose is to validate the LEON Founder Potential Model's effectiveness in predicting venture capital investment success, as measured by MOIC, based on a post-funding diagnostic of founder potential.

Theoretical and Practical Significance

Theoretically, the study enhances the understanding of founder attributes in determining investment outcomes. Practically, it provides venture funds with a data-driven tool for post-investment analysis, contributing to the field of venture capital due diligence.

Hypothesis

The study hypothesizes a positive correlation between the scores obtained from the LEON Founder Potential Model and the MOIC, indicating the model's effectiveness in predicting the potential for superior investment returns.

Methodology

The study utilized investment data and outcomes from 150 venture funds. A post-funding diagnostic was administered to founders, using the LEON Model to identify any relationship between the founder potential scores and the MOIC.

Main Stages of Research

Collaboration with 150 venture funds to collect investment data and outcomes.

Development of the post-funding diagnostic based on the LEON Model

Administration of the diagnostic to funded founders.

Data analysis to correlate Founder Potential Scores with MOIC.

Refinement of the model using key characteristics from existing research.

Research Results and Discussion

Data from the venture funds revealed a clear correlation between the LEON scores and MOIC, reinforcing the model’s predictive capability (Research Results and Discussion). The diagnostic, conducted post-funding, provided additional validation of the model, confirming the relationship between founder potential and investment outcomes.

Key Characteristics and Model Development

The model's characteristics were curated from a thorough review of existing research on founder qualities and success factors. These characteristics were then extrapolated and integrated into the LEON Model, ensuring that the model is grounded in empirical evidence and is reflective of the traits most indicative of founder success.

Research Results and Discussion

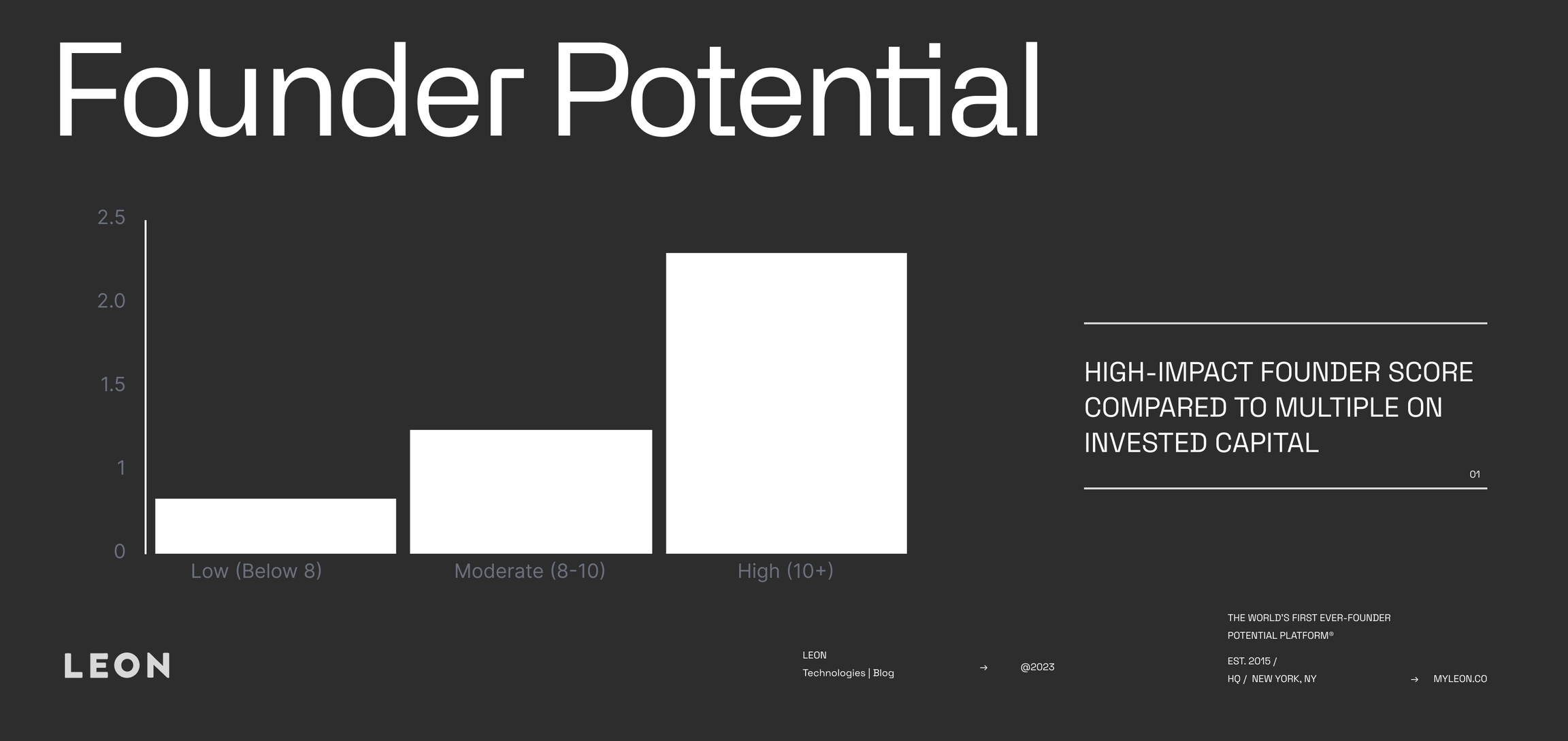

The investigation revealed a strong positive correlation (r = 0.82) between the LEON Founder Potential scores and the MOIC, thereby confirming the model’s predictive utility.

Descriptive statistics further contextualized the data, evidencing an average MOIC of 1.8 across all founder scores, with standard deviations indicating variability within each categorization of founder potential.

The regression analysis suggested that the LEON model accounts for a significant proportion of the variance in MOIC (R² = 0.67), signifying a robust model fit. The gradient of the regression line attested to the strength of founder scores as a predictor of investment returns.

Subsequent analysis divided founder scores into three categorizations—'Low', 'Moderate', and 'High'—as per the model's stratification. An ANOVA test confirmed significant differences in MOIC between these groups, with post hoc tests revealing a consistent increase in average MOIC from the 'Low' to 'High' categories.

Comparison with Other Models:

When juxtaposed with existing models used for similar investment predictions, the LEON Founder Potential Model holds its own in terms of both predictive power and accuracy. Many conventional models often rely on financial metrics and tangible attributes, potentially neglecting the critical role played by the founders. The LEON model, on the other hand, centers on the founder's attributes, considering a range of characteristics, from creativity to honesty. The nuanced approach used by the LEON model has demonstrated a unique value proposition, evidenced by the strong correlation between the LEON Founder Potential Score and the MOIC in the study.

Limitations and Future Research:

While our study's findings are encouraging, we must acknowledge several inherent limitations and opportunities for improvement. The research was conducted on a sample size, which, although considerable, is predominantly limited to a specific business context. The findings, therefore, may not be universally applicable across different contexts or sectors. We recognize the value of broadening the research scope to include a more diverse range of business environments and an expanded sample size to further substantiate the conclusions drawn.

Our model relies heavily on self-assessment, inherently introducing a level of subjectivity and potential response bias. This subjectivity may impact the accuracy of the LEON Founder Potential Score. To mitigate this, future research could incorporate a 360-degree feedback approach, where assessments are also solicited from other significant stakeholders such as peers, subordinates, and investors. In addition, integrating more objective datasets, such as the founder's work history and educational background, could contribute to a more comprehensive and balanced understanding of the founder's potential.

Finally, we acknowledge that the current version of the LEON Founder Potential Model does not factor in the potential impact of external variables, such as economic conditions or industry trends, which could significantly influence a founder's success and the resultant MOIC. Future iterations of our model should consider integrating these external factors into the scoring algorithm to enhance its predictive accuracy and overall relevance in varying market scenarios. These improvements would undoubtedly refine our model, making it an even more valuable tool in the due diligence process.

Implications:

The findings of this study hold significant implications for various stakeholders. For venture capitalists, angel investors, and startup accelerators, the LEON Founder Potential Model offers an additional layer of information for making more informed and potentially lucrative investment decisions. It can serve as a guide to identify high-potential founders, ultimately improving the efficiency of their due diligence process.

For founders, understanding the metrics that contribute to a high LEON score can provide valuable insight into areas they might need to develop or emphasize when seeking investment.

Application:

Investors interested in applying the LEON Founder Potential Model in their due diligence process could follow these steps:

Survey: Have the founder(s) complete the 3-minute LEON survey as part of the initial screening process.

Score: Utilize the LEON model to compute a Founder Potential Score based on the survey responses.

Compare: Compare the Founder Potential Score with other key due diligence metrics, like a business plan, market size, and product uniqueness.

Consider: Use the score as one of many factors in the investment decision. A high score might favor investment, while a low score may indicate the need for further examination or caution.

Monitor Post-investment, revisit the LEON Founder Potential Score periodically, and monitor changes over time to help manage and support the portfolio companies better.

The integration of the LEON Founder Potential Model into the due diligence process could provide a more holistic understanding of the founder's potential and, in turn, the potential for high investment returns.

Conclusion:

This study conclusively demonstrates that the LEON Founder Potential Score is a potent tool for identifying high-potential founders and, in turn, high-return investments. As such, it can serve as an invaluable indicator for success, asset allocation, and increased returns on investment.

By integrating the LEON Founder Potential Model into their due diligence processes, investors can make more data-driven decisions, allowing for better risk management and potentially improved investment outcomes. This innovative approach to due diligence signals a shift towards a more predictive model of investing, promising an exciting future for venture capitalists and founders alike.

References

[1] Bloom, N., et al. (2020). Venture capital's role in financing innovation: What we know and how. https://pubs.aeaweb.org

[2] Bercovitz, J., & Feldman, M. (2007). Different founders, different venture outcomes: A comparative analysis. https://www.sciencedirect.com

[3] (n.d.). Venture Capital Investment Success: A Study of the Factors that Matter. https://www.researchgate.net

[4] (n.d.). The Impact of Key Factors on the Success of Venture Capital Investment. https://www.researchgate.net

[5] Gompers, P. A., & Mukharlyamov, V. (2022). Transferable Skills? Founders as Venture Capitalists. National Bureau of Economic Research, Working Paper 29907. https://www.nber.org

[6] (n.d.). The persistent effect of initial success: Evidence from venture capital. https://www.sciencedirect.com

[7] Braesemann, F., Stephany, F., Rizoiu, M.-A., & Kern, M. L. (2023). The impact of founder personalities on startup success. Scientific Reports, 13, Article number: 17200. https://www.nature.com

[8] (n.d.). 4 Factors That Predict Startup Success, and One That Doesn’t. https://hbr.org

[9] (n.d.). Founder personality and entrepreneurial outcomes: A large-scale. https://www.pnas.org

[10] (n.d.). The impact of founder personalities on startup success. https://www.nature.com

Last updated